[

{

"name": "Real 1 Player (r2) - Inline",

"component": "38482494",

"insertPoint": "2/3",

"requiredCountToDisplay": "9"

}

]

Installment loans are one of the best personal loans, letting you borrow any amount between $1000 to $100,000. After getting approval for installment loans online, you need to reimburse them in monthly installment payments. However, the terms and conditions for these installment loans are solely dependent on the lender and range from 2-7 years.

Such types of loans can assist you in covering any massive home repair or emergency medical bills. Understandably, your poor credit score is one of the major reasons that hinder you from taking such a loan. But do you know you’re eligible for loans with low credit scores?

A few best online installment loan services are:

1: Upgrade - Get the best online installment loans of $1,000-$50,000.

2: Upstart - Borrow $1,000-$50,000 easily from this loan company.

2: USInstallmentLoans - Obtain a $50 to $5000 loan without bothering your credit score.

4. WeLoans - Get no credit check installment loans today.

To help you choose the top-notch loan companies for bad credit from the top options, we analyzed every lender based on their terms, APR, loan amounts, approval rate, etc. So, here are the top 10 bad credit installment loans.

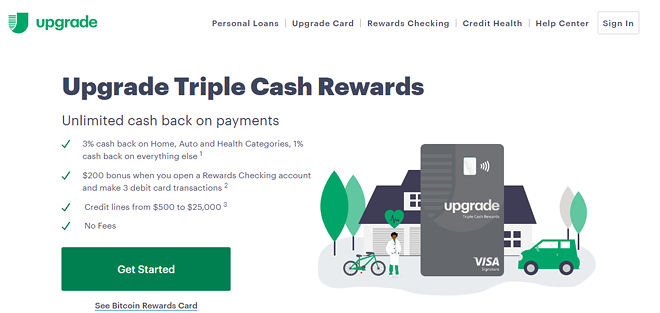

Upgrade

Upgrade gives you numerous loan options, for example, payday loans, installment loans, personal loans, etc., to decide which will work best for your interest.

With easy approval installment loans for bad credit from Upgrade, you can borrow from $1000 to $50,000 at a reimbursement term of 24-84 months. Also, you’re eligible for getting limitless cash back on payments, such as 3% on home and 1% on everything else.

As far as its costs and fees are concerned, the installment loans from Upgrade possess APRs starting from 5.94% to 35.97% based on your credentials. However, their online installment loans for bad credit have a 2.9% to 8% origination charge, which will be levied on the monthly loan payments.

Pros

- You can apply for installment loans even if you have a 580 credit score.

- Lower fixed rates.

- 1-day funding.

Cons

- High APR and origination fees.

Get online installment loans of $1,000-$50,000 on Upgrade.

Upstart

Do you want to borrow the best online loans for bad credit? With Upstart, you can borrow $1,000-$50,000 at 5.42% to 35.99% APR.

Upstart, being one of the best installment loans for bad credit online, uses conventional underwriting models to gauge eligibility. This organization helps individual loan seekers with a poor credit history and secure loans for bad credit. Moreover, it has a minimum loan amount of $1000 and a maximum borrowing of $50,000.

The lenders of this platform offer either 36 or 60 months of repayment loan terms. As far as its eye-catching costs and fees are concerned, Upstart provides an amazing lower APR range from 5.38% to 35.99%. Compared to most lenders, you have to pay an origination fee from 0% to 8% of the entire loan amount.

Pros

- No prepayment penalties.

- Finding will be credited within 1 business day.

Cons

- In case your payment is due for 15 days, you have to pay a late charge of 5% of the overdue balance.

Get a loan even with thin credit histories on Upstart

USInstallmentLoans

At USInstallmentLoans, you can borrow $50 to $5000 without bothering your credit score. Hence, if you’re searching for bad credit loans near me, it’s your one-stop destination.

Availing of USInstallmentLoans is a hassle-free process because they have renowned lenders who can borrow you money up to $5000. They collaborate with the industry-oriented lender in the US, and, therefore, are one of the best bad credit loan companies.

Although they aren’t the direct online lenders, they help you transfer your loan application form to the desired lender. So, to get the bad credit loans online, you have to fill out the form and provide adequate information, make decisions quickly, and receive funds within a day.

Pros

- Besides installment loans, you can also obtain a cash advance, same-day loans, title loans, quick loans, etc.

- 1-day funding is available.

Cons

- The lenders on this site might sometimes do a credit check first.

Go to USInstallmentLoans to look for a suitable lender

WeLoans

Don’t struggle with unexpected expenses as WeLoans has come up with no credit check installment loans, where you can borrow from $50 to $5000.

As WeLoans offers seamless access to a wide array of online lenders in the marketplace, comparing fees becomes a piece of cake. These no credit check installment loans from WeLoans come with flexible terms of loan repayment for you to explore more.

As you can borrow any amount up to $5000, the lenders will quickly approve and transfer the desired money to your bank account. Thus, they save you the hassles of visiting brick-and-mortar payday loan stores and waiting in the queue.

Pros

- Receive installment loans for bad credit instantaneously.

- Flexible loan terms and competitive interest charges.

- Improved security and privacy.

Cons

- You will be disqualified from these legit loans for bad credit if you don’t have a steady source of income.

Get no credit check installment loans through WeLoans

The legit personal loans for bad credit from LendingPoint are the most convenient options for people. Such loans can be quickly funded and must be compensated for 2-5 years. This installment loan provider stands out due to its fast funding and flexible payment options for loans from $2000 to $36500.

The borrowers can personalize some features of reimbursement, like managing payments monthly or weekly. Customers can also opt for their loan paying-off date when they sign the loan covenant and alter it once a year. On the other hand, LendingPoint offers countless ways to pay them back, for example, mailed-in checks, online or mobile apps, and ACH.

Pros

- Delicate credit check with pre-qualification.

- It can fund a loan quickly, for example, within a day.

Cons

- It doesn’t provide direct payment to the creditors with debt consolidation loans.

Universal Credit Express

Universal provides one of the best installment loans for people with bad credit. It allows you to borrow a minimum of $1000 to a maximum of $50,000.

This is one of the best bad credit loan companies established in 2006, and their team of veteran experts helps you get instant funding within a day or two. In order to apply for online installment loans from Universal Credit Express, you must be at least 18 years old and have a steady income of $210 or more.

It lends you money worth $1000 to $50,000 at an annual fixed rate of 3% based on the amount taken and the loan duration. The best feature of availing of their services is requesting the modulation of your loan reimbursements up or down every 6 months.

Pros

- Lower interest rates.

- You are allowed to ask for the postponement of a monthly payment every year.

- The loan insurance covers you if sudden demise happens and total loss of autonomy due to an accident.

Cons

- It might not be a credible site to apply for a loan.

Avant

Are you looking for the best loans for low monthly payments? Avant is a top-notch lending service offering both secured and unsecured loans. Therefore, secure loans for bad credit usually have a lower interest rate than their unsecured counterparts.

This online lender concentrates on the consumers with moderate to decent credit to possess a low minimum credit score. Being a top-notch lending service, it provides legit personal loans for bad credit.

In order to cover up the enhanced risk linked with subprime lenders, Avant has a high APR range and demands countless fees, for example, an origination fee of 4.75% of the total loan amount.

Pros

- It is amazing for low monthly payments, and you can borrow loan amounts of $2000 to $35,000.

- A moderate loan term will be from 24-60 months,

- Applicants must have a credit score of 580 to apply for installment loans.

Cons

- It doesn’t offer an autopay discount.

iPaydayLoans

As the emergency charges are unmissable, iPaydayLoans is always there for you to disburse payday loans for bad credit. If you’re wondering why everyone prefers iPaydayLoans, it’s because of their time efficiency. You can quickly get associated with some of their online lenders through any internet-enabled device.

All you have to do is fill out a loan application form and get instant approval from them. Moreover, if you’re running from a cash shortage, iPaydayLoans can give you a loan of $50 to the highest $5000. With their payday loans for bad credit, they will link you up with various lenders in their massive network whose offers match your loan requirements.

Pros

- The loan borrowing process is easy and fast.

- You can obtain any loan amount with your poor credit score.

Cons

- You are unable to borrow more than $5000.

Get any loan amount of $50 to $5000 from iPaydayLoans

LendingClub

LendingClub is the best option for those having moderate to decent credit scores due to its minimum credit score requirement. This company utilizes a peer-to-peer model or a marketplace lender.

With its secure loans for bad credit, you can consolidate credit card balances, reimburse high-interest debt, and save over $1000.

Instead of providing direct online installment loans, LendingClub helps you connect with the extensive network of lenders who give you the funds. However, like other online lenders, LendingClub charges various fees, including:

- A late charge of either $15 or 5% of the payment, whichever is maximum.

- An origination charge of between 3-6% of the total loan amount.

Pros

- They have flexible loan repayment terms of 36 and 60 months.

- You can apply for unsecured loans from $1000 to $40,000.

Cons

- It comparatively has a higher credit score requirement.

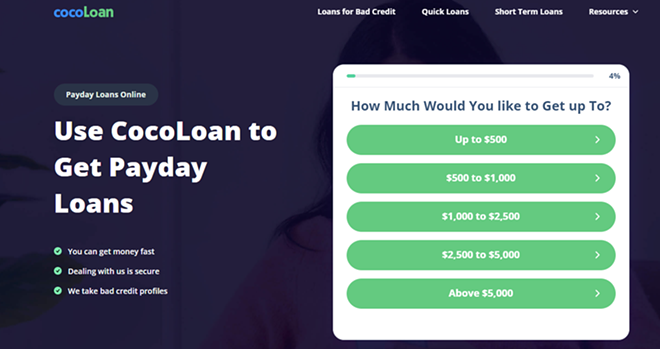

CocoLoan

If you want to get instantly approved payday loans with bad credit, no one can beat CocoLoan.

Here, you are eligible for getting $500 to above $5000. So, your search for the best bad credit loan companies should stop here at CocoLoan as it provides bad credit installment loans and bad credit payday loans.

Get your desired loan amount quickly after filling out a simple application form, submitting details, and waiting a few hours to get sanctioned by its lenders.

Be it installment loans or payday loans, CocoLoan can disburse cash up to $5000, which should be repaid on the next payday of the borrower. The biggest benefits of using CocoLoan are its online service, straightforward process, industry-leading lenders, and fast money transfer.

Pros

- Free of charge service.

- The amount you have applied for as a loan will be transferred within 15 minutes.

Cons

- You can’t borrow more than $5000.

Get instant Cash up to $5000 from CocoLoan.

What Are the Types of Installment Loans for Bad Credit?

Student loan

Such loans can help you pay for your living expenses and tuition while in school, and the loan duration will last a maximum of 10 years. The Federal student loans usually don’t do a credit check. Hence, getting qualified for them with bad credit is possible. However, student loans don’t need collateral.

Credit-builder loan

A credit-builder loan can guide you to fix your issue if you have a poor credit score. It mainly works as the reverse of a conventional loan. All you need to do is make monthly installments to a lender with a check or a bank transfer and then obtain the cash in your bank account. The lenders will report the credit bureaus on a monthly basis, which will help you boost your credit score as long as you pay on time.

Home equity loan

You can easily borrow against your home value minus mortgage balance, known as your home’s equity, for 5-30 years. Your house secures such type of loan; hence, you endanger foreclosure in case you can’t compensate for it. Moreover, you need to remember that home equity loans mainly need a credit score of approximately 680 for instant approval. But when you have maximum equity, there is a possibility that you could get one with poor credit.

Auto loan

An auto loan is another type of loan you can avail yourself of to purchase a car or other vehicle. It mainly lasts for 2 years to 3 years. In case you can’t repay the loan, your car could be taken back.

Top 7 Tips on Obtaining Installment Loans with Bad Credit

Work on credit progress

In case your loan isn’t that urgent, you could delay it for a few months until you hit the decent credit range of 640-699. After that, you can have various loan options with impressive terms.

Be aware of the expensive lenders

The auto title and payday lenders advertise instant funding and poor credit approval. But you must not consider them besides as a last alternative. They often charge exceptionally high fees and interest rates.

Consider credit unions

The credit unions provide quick access to budget-friendly loans. Sometimes, a credit union might offer the best payday alternative loans or personal loans geared toward flawed credit borrowers.

Obtain the amount faster if you are pre-qualified

Before applying, you can utilize any pre-qualification tool to verify your potential rates and acceptance odds with numerous lenders. It will guide you to bypass applying with a lender who’s likely to turn your application down.

Compare annual percentage rates

You need to understand different interest rates and fees as the lenders often use distinct criteria to estimate your interest rate. Obtain quotes from a few lenders and compare the rates, prepayment penalties, and origination fees to ascertain which will have the most budget-friendly loan interest for you.

Understand fees

Every online lender has different fees levied on your loan terms. Therefore, you should consider this beforehand and choose the right lender.

Check monthly installments

The minimum and maximum loan amount could vary from one lender to another. Also, the terms of their monthly installment would differ too! Hence, you must ensure the lender you opt for provides a monthly installment facility before applying.

Conclusion

Various best bad credit loan companies are available globally, which can solve your issue when you’ve been wondering how can I get a loan with bad credit? Although opting for the right installment loans online for bad credit seems overwhelming, every lender has different terms lengths, interest rates, fees, and credit history needs.

In case you have poor credit, we enlisted the 10 best bad credit loan companies above. Although the loan options are pretty limited, that doesn’t imply you need to settle for an untrustworthy or expensive lender. Simply put, Upgrade could be the best bad credit loan near me as you can get an approved loan lower than $1000 and obtain funds the next day.

However, all the above mentioned companies providing online installment loans for bad credit have amazing availability across the country and offer a competitive APR range. Finding the best installment loans could be difficult, but this guide must have made everything simpler.